Poor E.J. Dionne! He is suffering through the same transition process experienced by many Obama supporters who have been confronted with the demise of the President’s phony “populist” image. The stages one passes through when coping with such an “image death” are identical to those described in the Model of Coping with Dying, created in 1969 by Psychiatrist, Dr. Elisabeth Kübler-Ross. For example, a few weeks ago, Bill Maher was passing through the “Bargaining” stage – at which point he suggested that if we elect Obama to a second term in the White House, the President will finally stand up for all of those abandoned principles which candidate Obama advocated during the 2008 campaign. As we saw during Friday’s episode of Maher’s Real Time program on HBO, the comedian has now progressed to the “Acceptance” stage, as demonstrated by his abandonment of any “hope” that Obama’s pseudo-populist image might still be viable.

Meanwhile E.J. Dionne appears to be transitioning from the “Denial” stage to the “Anger” stage – as exemplified by his dwelling on the issue of who is to blame for this image death. Dionne’s conclusion is that “Centrists” are to blame. Dionne’s recent Washington Post column began with the premise that “centrism has become the enemy of moderation”. While attempting to process his anger, Dionne has expounded some tortured logic, rambling through an elaborate “distinction without a difference” comparison of “Centrists” with “Moderates”, based on the notion that Moderates are good and Centrists are bad. Dionne’s article was cross-posted at the Truthdig blog, where many commentors criticized his argument. One reason why so many Truthdig readers had less trouble accepting the demise of Obama’s false “populist” image, could have been their exposure to the frequent criticism of Obama appearing at that website – as exemplified by this cartoon by Mr. Fish, which appeared immediately to the left of Dionne’s article on Saturday.

An easy way to make sense of Dionne’s thought process at this “Anger” stage is to replace any references to “centrists” or “centrism” by inserting Obama’s name at those points. For example:

Because

centrismObama is reactive, you never really know whata centristObama believes.Centrists areObama is constantly packingtheirhis bags and chasing off to find a new location as the political conversation veers one way or another.* * *

Yet

the center’s devotees, in politics and in the media,Obama fear(s) saying outright that by any past standards—or by the standards of any other democracy—the views of this new right wing are very, very extreme and entirely impractical.CentristsObama worr(ies) that saying this might makethemhim look “leftist” or “partisan.”Instead,

the centerObama bends.ItHe concocts deficit plans that include too little new tax revenue.ItHe accepts cuts in programs that would have seemed radical and draconian even a couple of years ago.ItHe pretends this crisis is caused equally by conservatives and liberals when it is perfectly clear that there would be no crisis at all if the right hadn’t glommed onto the debt ceiling as the (totally inappropriate) vehicle for its anti-government dreams.It’s time for moderates to abandon

centrismObama and stop shifting with the prevailing winds. They need to state plainly what they’re for, stand their ground, and pull the argument their way. Yes, they would risk looking to “the left” of wherethe centerObama is now – but only because conservatives have pulledithim so far their way.

Toward the end of the piece we see how Dionne is getting some glimpses of the fact that Obama is the problem:

But when this ends, it’s Obama who’ll need a reset. At heart, he’s a moderate who likes balance. Yet Americans have lost track of what he’s really for. Occasionally you wonder if he’s lost track himself. He needs to remind us, and perhaps himself, why he wants to be our president.

In reality, Barack Obama was able to deceive Americans by convincing them that he was for populist causes rather than corporatist goals. The President never “lost track of what he’s really for”. He has always been Barry O. Tool – a corporatist.

At the conclusion of Dionne’s essay we learn that – contrary to what we were told by Harry Truman – “the buck” stops at the desks of Obama’s “centrist advisers”:

His advisers are said to be obsessed with the political center, but this leads to a reactive politics that won’t motivate the hope crowd that elected Obama in the first place. Neither will it alter a discourse whose terms were set during most of this debt fight by the right.

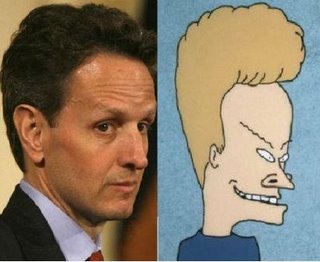

We’ve heard the “blame the advisers” rationale from others who passed through the Kübler-Ross phases at earlier points during the Obama Presidency: There were those who sought to blame Rahm Emanuel when the “public option” was jettisoned from Obama’s healthcare bill. We then heard from the “Hope fiends” who blamed Larry Summers, Tim Geithner and Peter Orszag for Obama’s refusal to seriously consider the “Swedish solution” of putting the zombie megabanks through temporary receivership. In fact, it was Obama making those decisions all along.

I’m confident that once E.J. Dionne reaches the “Acceptance” stage, we will hear some refreshing, centered criticism of President Obama.

Once Upon A Crisis

As the 2012 Presidential election campaign heats up, there is plenty of historical revisionism taking place with respect to the 2008 financial / economic crisis. Economist Dean Baker wrote an article for The Guardian, wherein he debunked the Obama administration’s oft-repeated claim that the newly-elected President saved us from a “Second Great Depression”:

Joe Weisenthal of The Business Insider directed our attention to the interview with economist Paul Krugman appearing in the current issue of Playboy. Krugman, long considered a standard bearer for the Democratic Party’s economic agenda, was immediately thrown under the bus as soon as Obama took office. I’ll never forget reading about the “booby prize” roast beef dinner Obama held for Krugman and his fellow Nobel laureate, Joseph Stiglitz – when the two economists were informed that their free advice would be ignored. Fortunately, former Chief of Staff Rahm Emanuel was able to make sure that pork wasn’t the main course for that dinner. Throughout the Playboy interview, Krugman recalled his disappointment with the new President. Here’s what Joe Weisenthal had to say about the piece:

What follows is the prescient excerpt from Krugman’s March 9, 2009 essay, referenced by Joe Weisenthal:

In early July of 2009, I wrote a piece entitled, “The Second Stimulus”, in which I observed that President Obama had already reached the milestone anticipated by Krugman for September of that year. I made a point of including a list of ignored warnings about the inadequacy of the stimulus program. Most notable among them was the point that there were fifty economists who shared the concerns voiced by Krugman, Stiglitz and Jamie Galbraith:

Mike Grabell of ProPublica has written a new book entitled, Money Well Spent? which provided an even-handed analysis of what the stimulus did – and did not – accomplish. As I pointed out on February 13, some of the criticisms voiced by Mike Grabell concerning the programs funded by the Economic Recovery Act had been previously expressed by Keith Hennessey (former director of the National Economic Council under President George W. Bush) in a June 3, 2009 posting at Hennessey’s blog. I was particularly intrigued by this suggestion by Keith Hennessey from back in 2009:

Given the fact that the American economy is 70% consumer-driven, Keith Hennessey’s proposed stimulus would have boosted that sorely-missing consumer demand as far back as two years ago. We can only wonder where our unemployment level and our Gross Domestic Product would be now if Hennessey’s plan had been implemented – despite the fact that it would have been limited to the $787 billion amount.