Now it’s official. Christina Romer was right. The signs that she was about to be proven correct had been turning up everywhere. When Charles Kaldec of Forbes reminded us – yet again – of President Obama’s willful refusal to seriously consider the advice of the former Chair of his Council of Economic Advisers, it became apparent that something was about to happen . . .

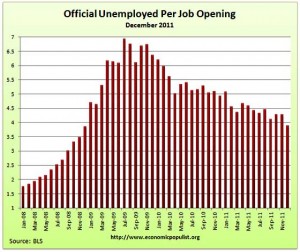

On Friday morning, the highly-anticipated non-farm payrolls report for April was released by the Department of Labor’s Bureau of Labor Statistics (BLS). Although economists had been anticipating an increase of 165,000 jobs during the past month, the report disclosed that only 115,000 jobs were added. In other words, the headline number was 50,000 less than the anticipated figure, missing economists’ expectations by a whopping 31 percent. The weak 115,000 total failed to match the 120,000 jobs added in March. Worse yet, even if payrolls were expanding at twice that rate, it would take more than five years to significantly reduce the jobs backlog and create new jobs to replace the 5.3 million lost during the recession.

Because this is an election year, Republicans are highlighting the ongoing unemployment crisis as a failure of the Obama Presidency. On Friday evening’s CNN program, Anderson Cooper 360, economist Paul Krugman insisted that this crisis has resulted from Republican intransigence. Bohemian Grove delegate David Gergen rebutted Krugman’s claim by emphasizing that Obama’s 2009 economic stimulus program was inadequate to address the task of bringing unemployment back to pre-crisis levels. What annoyed me about Gergen’s response was his dishonest implication that President Obama’s semi-stimulus was Christina Romer’s brainchild. Nothing could be further from the truth. The stimulus program proposed by Romer would have involved a more significant, $1.8 trillion investment. Beyond that, the fact that unemployment continues for so many millions of people who lost their jobs during the recession is precisely because of Barack Obama’s decision to ignore Christina Romer. I have been groaning about that decision for a long time, as I discussed here and here.

My February 13 discussion of Noam Scheiber’s book, The Escape Artists, demonstrated how abso-fucking-lutely wrong David Gergen was when he tried to align Christina Romer with Obama’s stimulus:

The book tells the tale of a President in a struggle to create a centrist persona, with no roadmap of his own. In fact, it was Obama’s decision to follow the advice of Peter Orszag, to the exclusion of the opinions offered by Christina Romer and Larry Summers – which prolonged the unemployment crisis.

* * *

The Escape Artists takes us back to the pivotal year of 2009 – Obama’s first year in the White House. Noam Scheiber provided us with a taste of his new book by way of an article published in The New Republic entitled, “Obama’s Worst Year”. Scheiber gave the reader an insider’s look at Obama’s clueless indecision at the fork in the road between deficit hawkishness vs. economic stimulus. Ultimately, Obama decided to maintain the illusion of centrism by following the austerity program suggested by Peter Orszag:

BACK IN THE SUMMER of 2009, David Axelrod, the president’s top political aide, was peppering White House economist Christina Romer with questions in preparation for a talk-show appearance. With unemployment nearing 10 percent, many commentators on the left were second-guessing the size of the original stimulus, and so Axelrod asked if it had been big enough. “Abso-fucking-lutely not,” Romer responded. She said it half-jokingly, but the joke was that she would use the line on television. She was dead serious about the sentiment. Axelrod did not seem amused.

For Romer, the crusade was a lonely one. While she believed the economy needed another boost in order to recover, many in the administration were insisting on cuts. The chief proponent of this view was budget director Peter Orszag. Worried that the deficit was undermining the confidence of businessmen, Orszag lobbied to pare down the budget in August, six months ahead of the usual budget schedule. . . .

The debate was not only a question of policy. It was also about governing style – and, in a sense, about the very nature of the Obama presidency. Pitching a deficit-reduction plan would be a concession to critics on the right, who argued that the original stimulus and the health care bill amounted to liberal overreach. It would be premised on the notion that bipartisan compromise on a major issue was still possible. A play for more stimulus, on the other hand, would be a defiant action, and Obama clearly recognized this. When Romer later urged him to double-down, he groused, “The American people don’t think it worked, so I can’t do it.”

That’s a fine example of great leadership – isn’t it? “The American people don’t think it worked, so I can’t do it.” In 2009, the fierce urgency of the unemployment and economic crises demanded a leader who would not feel intimidated by the sheeple’s erroneous belief that the Economic Recovery Act had not “worked”.

Ron Suskind’s book, Confidence Men is another source which contradicts David Gergen’s attempt to characterize Obama’s stimulus as Romer’s baby. Last fall, Berkeley economics professor, Brad DeLong had been posting and discussing excerpts from the book at his own website, Grasping Reality With Both Hands. On September 19, Professor DeLong posted a passage from Suskind’s book, which revealed Obama’s expressed belief (in November of 2009) that high unemployment was a result of productivity gains in the economy. Both Larry Summers (Chair of the National Economic Council) and Christina Romer (Chair of the Council of Economic Advisers) were shocked and puzzled by Obama’s ignorance on this subject:

“What was driving unemployment was clearly deficient aggregate demand,” Romer said. “We wondered where this could be coming from. We both tried to convince him otherwise. He wouldn’t budge.”

Obama’s willful refusal to heed the advice of Cristina Romer has facilitated the persistence of our nation’s unemployment problem. As Ron Suskind remarked in the previously-quoted passage:

The implications were significant. If Obama felt that 10 percent unemployment was the product of sound, productivity-driven decisions by American business, then short-term government measures to spur hiring were not only futile but unwise.

There you have it. Despite the efforts of Obama’s apologists to blame Larry Summers or others on the President’s economic team for persistent unemployment, it wasn’t simply a matter of “the buck stopping” on the President’s desk. Obama himself has been the villain, hypocritically advocating a strategy of “trickle-down economics” – in breach of his campaign promise to do the exact opposite.

As Election Day approaches, it becomes increasingly obvious that the unemployment situation will persist through autumn – and it could get worse. This is not Christina Romer’s fault. It is President Obama’s legacy. Christina Romer was right and President Obama was wrong.